After the Covid-19 pandemic, the demand for Fintech mobile apps is at an all-time high. People are now realizing the importance of managing finances by sitting in their homes. Fintech ecompasses all financial technologies and offers convenience and efficiency at our fingertips.

Many startups and app developers have started to contemplate the development of Fintech mobile apps. And let us reiterate: it’s the best to do so.

But, building a fintech solution that is efficient, innovative and cost-effective at the same, is not an easy job.

If you’re determined to utilize your resources in this lucrative market, then you are at the right place.

This article will guide you with the essential steps to embark on this journey. At the end of this detailed guide, you will come well-prepared and informed, while keeping the crucial aspect of fintech app development cost in check.

So, let’s start.

1. Narrow Down Your Idea

Identifying your idea is the first and most important stage in creating a Fintech app. Spend some time thinking about the issues your app will address. Think of a big umbrella of topics and then narrow down your idea. Consider your target audience – is your app designed for personal finance management, small businesses, or investment enthusiasts? The features and functionality of your app are built on the foundation of a clearly defined idea.

2. Research Thoroughly

Comprehensive research is the cornerstone of any successful app development endeavor. Explore existing Fintech apps in the market. Analyze their features, user interfaces, and customer reviews. Identify gaps and opportunities for improvement. By understanding the strengths and weaknesses of existing applications, you can craft a unique selling proposition for your app, ensuring it stands out in the competitive Fintech landscape.

3. Sketch Your App

Visualize your app by sketching its layout and features. Create rough wireframes that outline the user interface and the flow of interactions. These sketches serve as a visual roadmap, helping you and your development team grasp the app’s structure and functionality.

It’s a fundamental step that bridges the gap between your conceptualization and the actual development process.

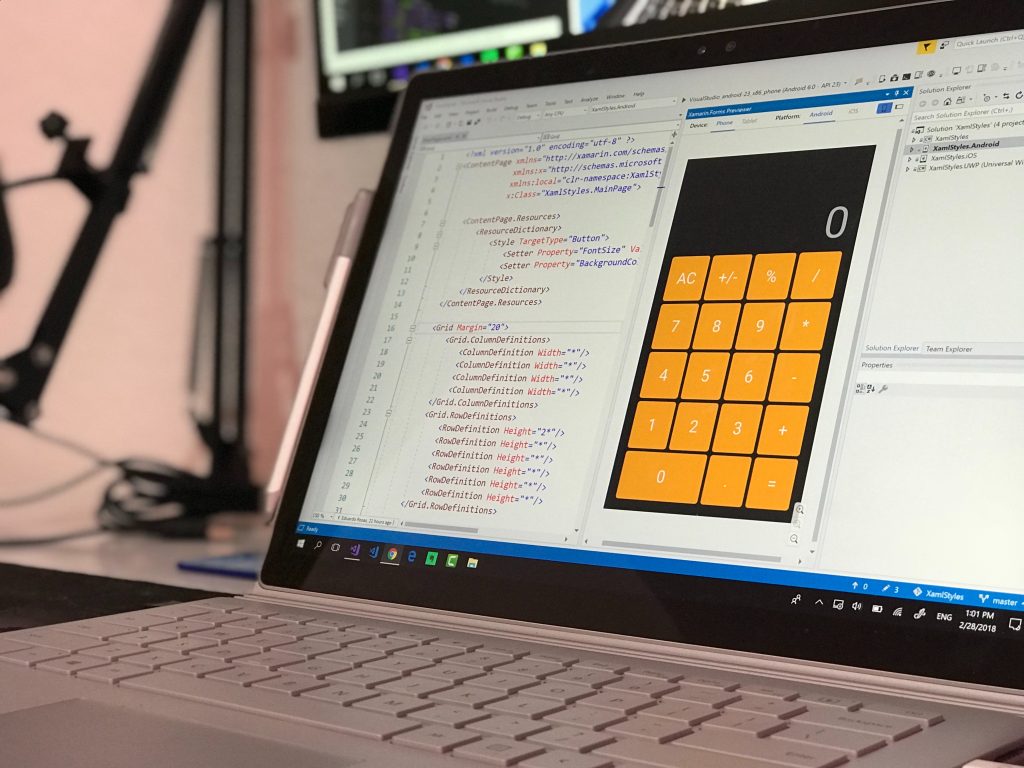

4. Choose the Right Platform / Technology Stack

Deciding the platform for your Fintech mobile app is pivotal. Consider your target audience and market share. Determine whether you want to develop for Android, iOS, or both platforms. Each platform has its unique user base and advantages. By choosing the right platform, you optimize your app’s reach and accessibility, ensuring it caters to a broader audience.

5. Find a Reliable Developer

Finding a reliable and experienced Fintech app developer is a critical decision. Research different development agencies or freelancers. Compare their portfolios, expertise, and most importantly, their fintech app development cost. While cost is a significant factor, ensure that the developer’s skills align with your project requirements. Collaborating with the right developer ensures a seamless development process, translating your vision into a functional and polished app.

6. Focus on Security

Security is paramount in Fintech app development. Since these applications handle sensitive financial data, implementing robust security measures is non-negotiable. Utilize encryption protocols, secure APIs, and multi-factor authentication to safeguard user information. Prioritizing security not only builds trust among users but also protects your app from potential data breaches and cyber threats.

7. Design a User-Friendly Interface

The user interface (UI) of your Fintech mobile app plays a pivotal role in user experience. Design an intuitive and user-friendly interface that simplifies complex financial processes. Ensure seamless navigation, logical information architecture, and visually appealing design elements.

A well-designed UI enhances user engagement, making financial management effortless and enjoyable for your users.

8. Integrate Payment Gateways

For Fintech apps, seamless payment processing is fundamental. Integrate secure payment gateways that support various payment methods, including credit/debit cards, digital wallets, and bank transfers. Streamline the payment process, ensuring users can make transactions effortlessly within the app. A smooth payment experience enhances user satisfaction, encouraging them to use your app for their financial transactions.

9. Testing is Key

Thorough testing is a crucial phase in app development. Conduct rigorous testing to identify and rectify bugs, glitches, and performance issues. User feedback during this stage is invaluable. Encourage users to participate in beta testing, allowing you to gather real-time feedback and make necessary improvements. Rigorous testing ensures your app functions seamlessly across different devices and operating systems, providing users with a reliable and glitch-free experience.

10. Launch and Market Your App

It’s time to release your mobile app in the market after carefully developing and testing it. Create a buzz about your app by creating a solid marketing plan. Utilize digital marketing techniques, social media platforms, and app store optimization (ASO) to enhance your app’s visibility. Highlight its unique features, benefits, and how it addresses users’ financial needs. A well-executed marketing campaign ensures your app reaches your target audience, driving downloads and user engagement.

11. Provide Excellent Support

Excellent customer support is the cornerstone of user satisfaction. Assist people quickly and effectively, responding to their questions, worries, and problems. Create avenues for communication, such as email, live chat, or an exclusive hotline. A responsive support system builds trust and credibility, fostering a positive relationship between your app and its users.

12. Gather Feedback

Encourage users to provide feedback on their app experience. Actively seek their suggestions, comments, and reviews. User feedback provides valuable insights into your app’s usability, functionality, and overall user satisfaction. Analyze this feedback and implement necessary enhancements. By continuously refining your app based on user input, you ensure it remains relevant and competitive in the ever-evolving Fintech landscape.

Final Conclusion

So far, we can conclude that a business cannot survive without a fintech solution. It is high time to transform traditional financial methods and adopt fintech applications. The process, however, should be backed by careful planning, meticulous execution and continuous improvement. Furthermore, you should be mindful of the fintech app development cost while building fintech-based mobile apps.